Life Insurance

Life insurance is an important part of your financial well-being, especially if others depend on you for support. In order to provide you and your family with financial protection in the event of your death, Evident Scientific offers Basic Term Life Insurance and Accidental Death and Dismemberment coverage (AD&D) to you and your dependents. This coverage is 100% paid by Evident Scientific. Coverage is automatic; you do not need to enroll.

Additionally, voluntary life insurance is available, offering the opportunity to supplement the life benefit provided by Evident Scientific. You can elect voluntary life insurance for yourself and your dependents through convenient payroll deduction. Rates are based on age and the coverage level chosen.

Beneficiaries

You will be required to provide your beneficiary information at the time of your enrollment. A beneficiary is a person who would receive your life insurance benefit in the event of your death. In the case of spouse or child life coverage that is elected, you are automatically listed as the beneficiary.

Basic Life and AD&D

Evident Scientific provides basic life and accidental death and dismemberment insurance to you and your dependents at no cost equal to 2 times Base Annual Earnings rounded to the next higher $1,000. The benefit amount is subject to a minimum of $10,000 and a maximum of $500,000 or flat $50,000.

Basic Life Insurance and Imputed Income

The IRS requires you to be taxed on the value of employer-provided group term life insurance over $50,000. The taxable value of this life insurance coverage is called “imputed income.” The imputed cost of coverage over $50,000 must be included in your income and is subject to taxation. To avoid this imputed income, employees can elect a flat $50,000 in coverage as opposed to 2x annual salary. On your paycheck you will see an amount (code 19) under deductions and the same amount under earnings. If an employee does not complete an active enrollment, they will be automatically enrolled in the $50,000 option, to avoid imputed income.

Voluntary Life and AD&D

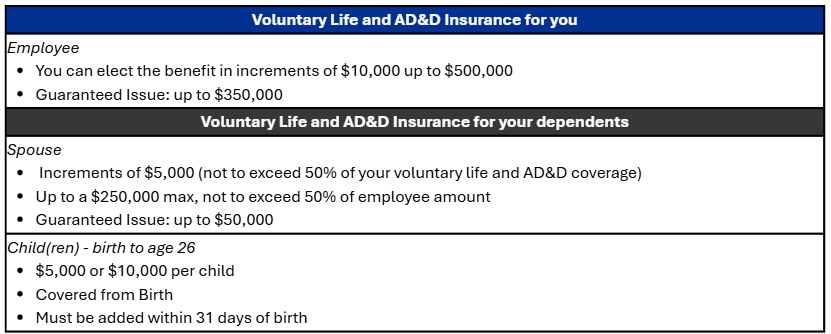

You may choose to purchase additional life and AD&D coverage for yourself and your dependents at affordable group rates. Rates are based on age and the coverage level chosen. Spouse Life Rates are based on the Employee age.

Special Enrollment Opportunity!

This Open Enrollment, Employees and Spouses can elect up to the Guaranteed Issue Amount, without health questions and/or a physical exam.

Important: If you use tobacco products and you fail to confirm this through the Tobacco Certification question, NYL has the right to deny any benefits payable under the plan. Anyone requesting an increase in his/her supplemental life insurance benefit amounts may be subject to Evidence of Insurability (EOI) by NYL.

Important: If you use tobacco products and you fail to confirm this through the Tobacco Certification question, NYL has the right to deny any benefits payable under the plan. Anyone requesting an increase in his/her supplemental life insurance benefit amounts may be subject to Evidence of Insurability (EOI) by NYL.

File Life/AD&D Claim - Employees

1. Before you File a Claim

Gather the following items before you begin:

Policy number(s) and coverage information

Personal information for the beneficiary, employee and/or decedent (as applicable) including full name, Social Security number, date of birth, relationship status, address, and contact information

Employment verification information and supporting documents

For death claims: Basic details about the decedent’s passing (e.g., date of death, cause of death), including a copy of the death certificate and funeral assignment, if available

All beneficiary designations

Any assignments, court orders, or other documents that may affect payment

Additional documents including medical records, police or medical examiner report, etc. if available/applicable

2. Filing a New Claim

Go to nylgbslifeclaims.com/claims.

Enter your email address to receive your login code, then log in to your claims dashboard. From here, you can either start a new claim or continue an existing one.

For new claims, click the New Claim button and select the claim type.

Read and accept the state fraud warnings.

Complete all required fields (marked with an asterisk*), upload the relevant documents, review the claim, and submit.

3. Continue an Existing Claim

To continue an existing claim (including those started by the beneficiary), select Open Claims and navigate to the claim you wish to Start or Continue.

Read and accept the state fraud warnings.

Complete all required fields (marked with an asterisk*).

Upload the relevant documents, review the claim, and submit.

4. Claim Review and Approval

A Life claims specialist will be assigned to your case. If we need additional information, they will contact you or the beneficiary directly.

After receiving all necessary documentation, a claim decision will be made within 10 business days.

If approved: We will notify you and send the beneficiary an approval communication via USPS.

If denied: You will be notified, and the beneficiary will receive a detailed explanation of the denial and instructions on how to appeal.

Alternative Filing Methods

Downloadable Forms: Access Life, Accidental Death and Dismemberment, Accelerated Death Benefit, or Waiver of Premium claim forms on the MyNYLGBS portal, or request them directly.

Email: Send completed claim forms and documents to claims.pghlif2@newyorklife.com

Fax: Send completed forms to (877) 300-6770

Mail: Send claim forms and documents to:

New York Life Group Benefit Solutions (NYL GBS)

Life & Accident Claim Services

P.O. Box 22328

Pittsburgh, PA 15222-0328

Questions/Check Claim Status: (888) 842-4462 (8:00 AM - 5:00 PM EST)

Survivor Support Specialist: (888) 842-4462 , ext. 1013382 (9:00 AM - 5:00 PM EST)

File Life/AD&D Claim - Beneficiaries

1. Before you File a Claim

You will need the following information on hand:

Personal information for yourself, the employee and/or decedent (as applicable) including full name, Social Security number, date of birth, relationship status, address and contact information

Employment verification information and supporting documents

For death claims: Basic details about the decedent’s passing (e.g., date of death, cause of death), including a copy of the death certificate and funeral assignment, if available

Employer name and policy number(s)

Medical records, police report, or any other relevant documents

2. Filing Your Claim

Go to nylgbslifeclaims.com/claims.

Select the claim type.

Opt in to receive email updates about your claim.

Complete the form to the best of your ability, providing all requested information. Fields marked with an [*] are required.

Upload any supporting documents. Document marked with an [*] are required.

Choose how you’d like to receive your payment: either via a lump sum check or through a NYL GBS Survivor Assurance account—a free, interest-bearing account in your name (this does not apply to Waiver of Premium claims).

Submit your claim form.

Download a copy of the completed form for your records.

3. Important Information

Policy Number for Life: SGM613243

Policy Number for Accident: SOK610123

Employer Name: Evident Scientific MIS, Inc.

Questions/Check Claim Status: (888) 842-4462 (8:00 AM - 5:00 PM EST)

Survivor Support Specialist: (888) 842-4462 , ext. 1013382 (9:00 AM - 5:00 PM EST)

Guaranteed Issue Amount

The Guaranteed Issue amount of life insurance is the maximum amount you can receive without completing an Evidence of Insurability form (EOI).

EMPLOYEE: up to $350,000

SPOUSE: up to $50,000

If you are applying for a life insurance sum above the guaranteed issue amount, you will need to complete an Evidence of Insurability (EOI) form. Contact the Benefits Service Center by phone at (888) 599-9934 or email help@evidentbenefits.com to request the EOI form.